Training course

T1 - Filing Personal Tax Return

T1 - Filing Personal Tax Return

T1 - Filing Personal Tax Return

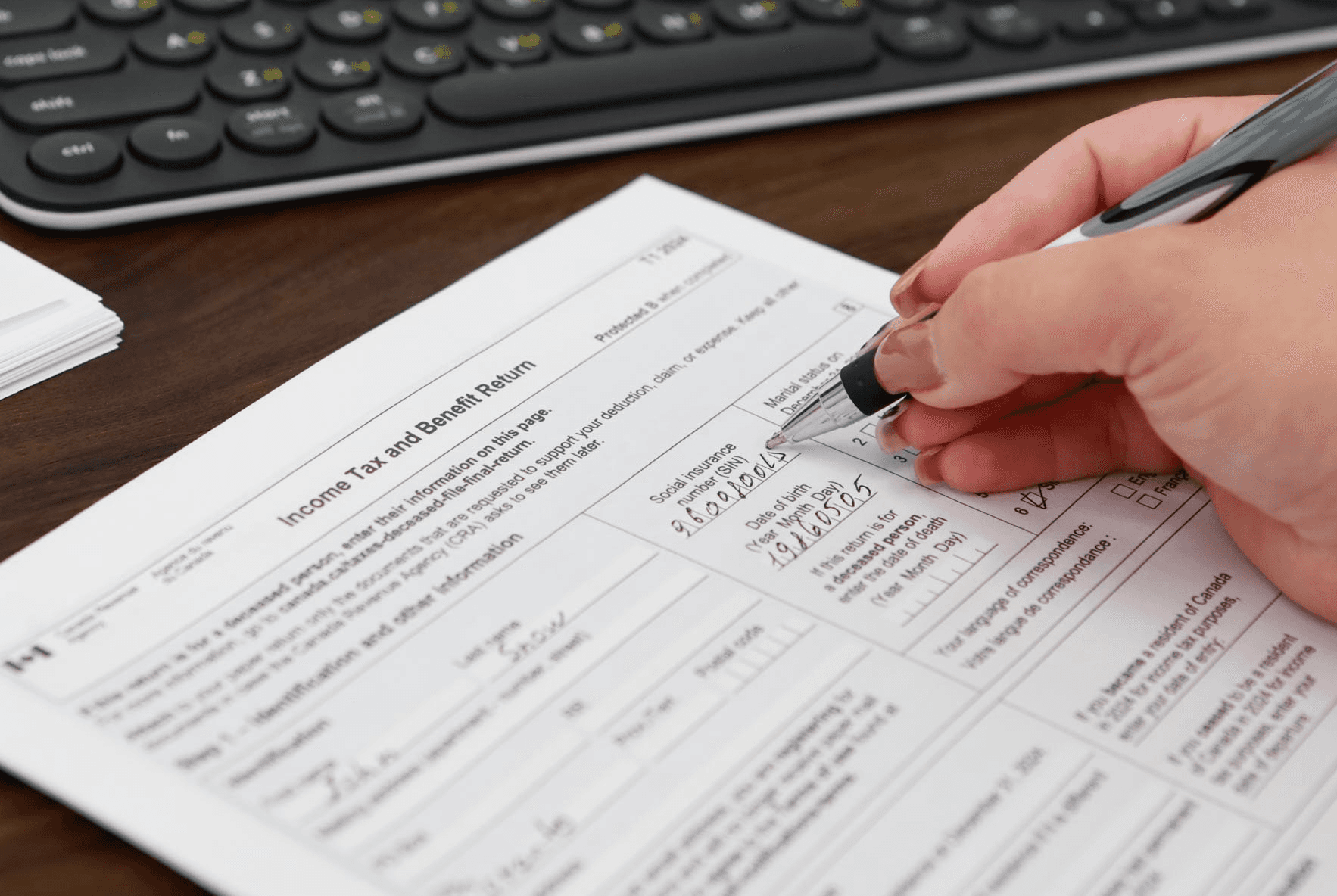

This course will help you go from a beginner to a professional in the field of tax returns. You will learn how to file returns on your own, work with tax software, use tax legislation, and even start your own business in accounting services.

This course will help you go from a beginner to a professional in the field of tax returns. You will learn how to file returns on your own, work with tax software, use tax legislation, and even start your own business in accounting services.

This course will help you go from a beginner to a professional in the field of tax returns. You will learn how to file returns on your own, work with tax software, use tax legislation, and even start your own business in accounting services.

Start

Start

January 19 - 2026

Format

Format

Hybrid: recorded lectures & online practice

Experience

Experience

Ideal for beginners

Features

About this course

About this course

It's one of the most comprehensive courses about personal taxes in Canada. Our secret - is our tutors, they are the true masters in what they do.

Master tax preparation

Master tax preparation

Master tax preparation

Filing taxes in Canada doesn’t have to be overwhelming. This course helps you go from zero to confidently handling personal tax returns — including employment, self-employment, investments, and deductions. Whether you're filing for yourself or planning to help others, you'll build real skills that stay valuable for life.

Filing taxes in Canada doesn’t have to be overwhelming. This course helps you go from zero to confidently handling personal tax returns — including employment, self-employment, investments, and deductions. Whether you're filing for yourself or planning to help others, you'll build real skills that stay valuable for life.

Tools and Knowledge

Tools and Knowledge

Tools and Knowledge

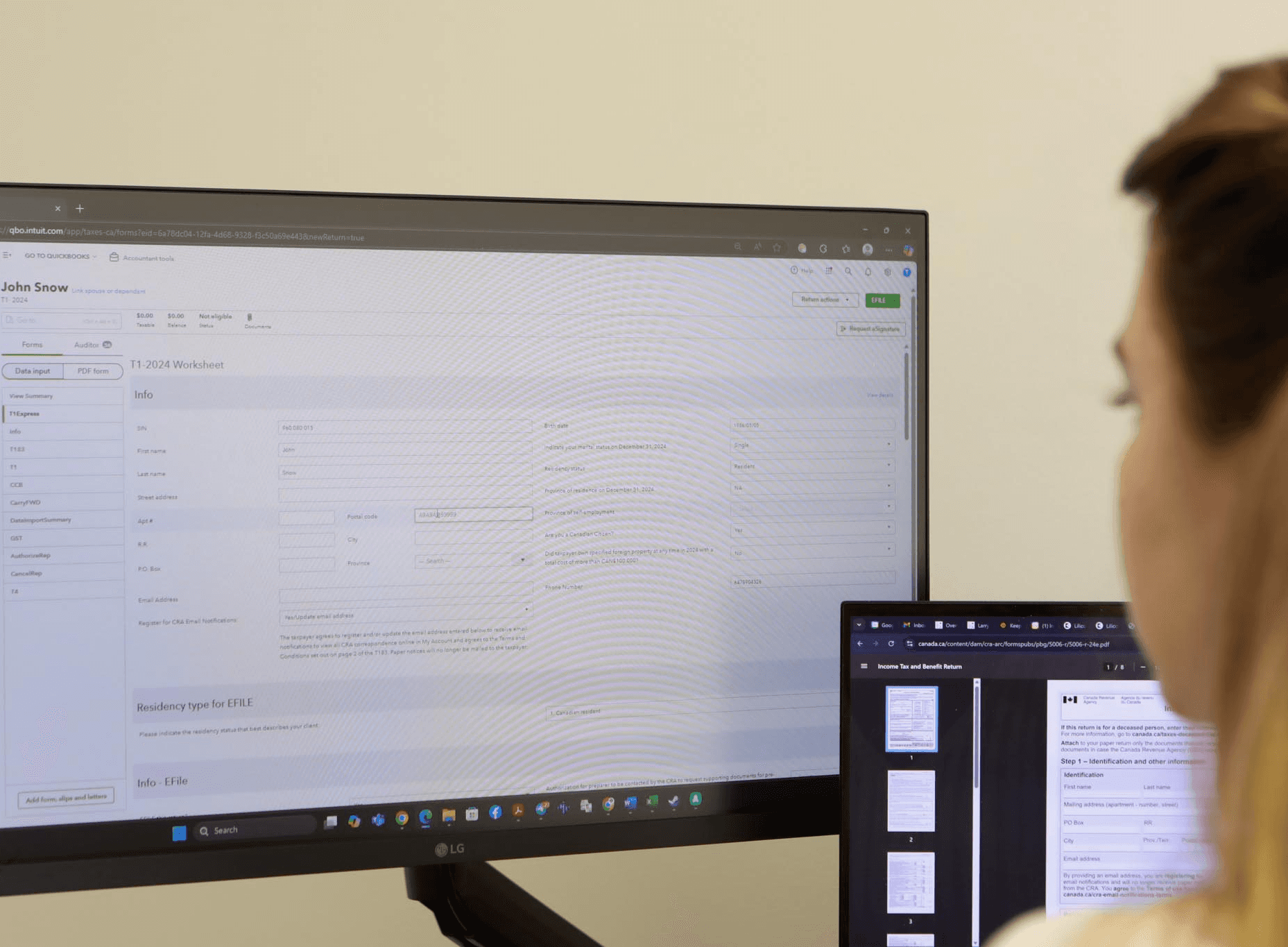

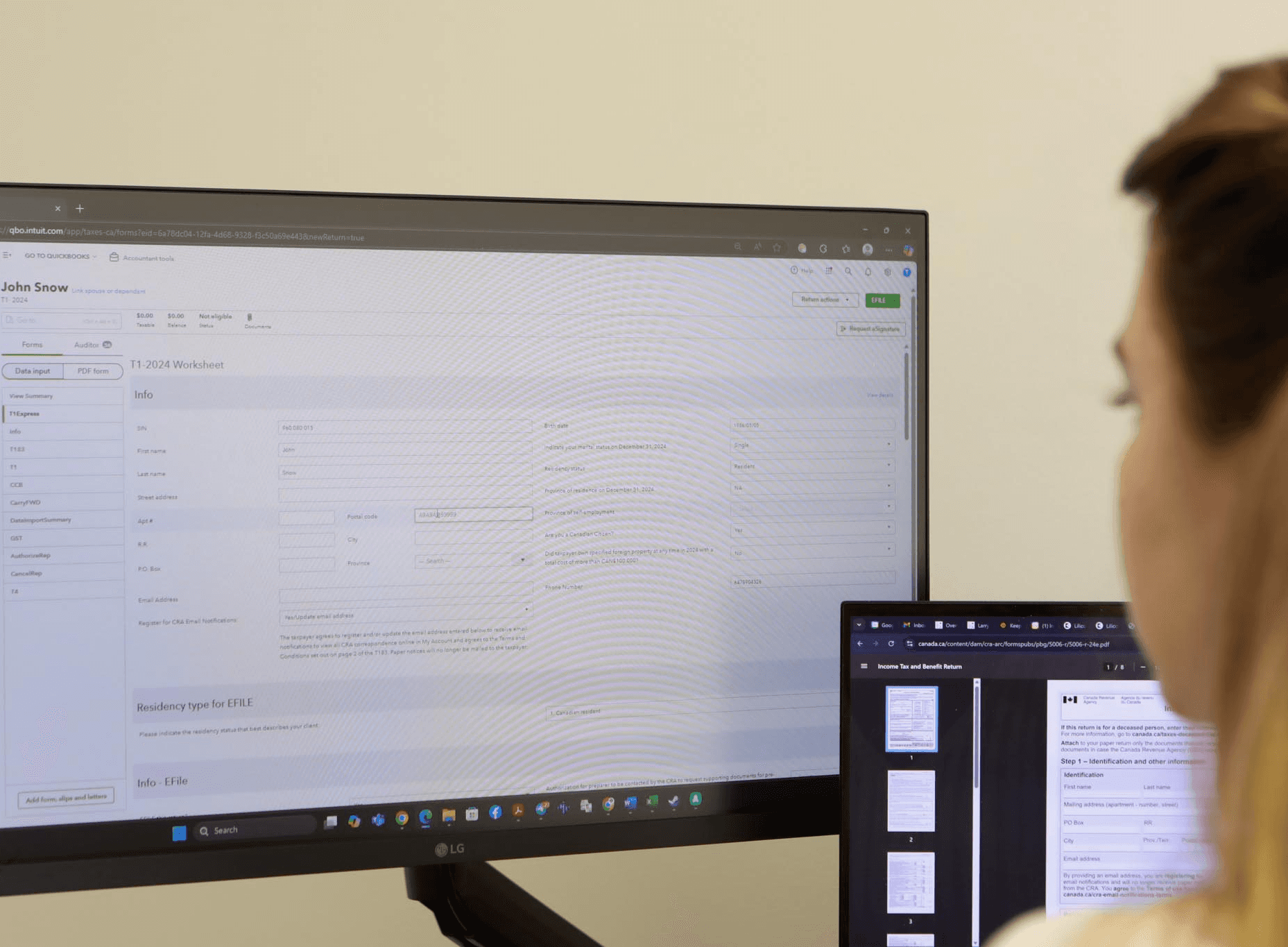

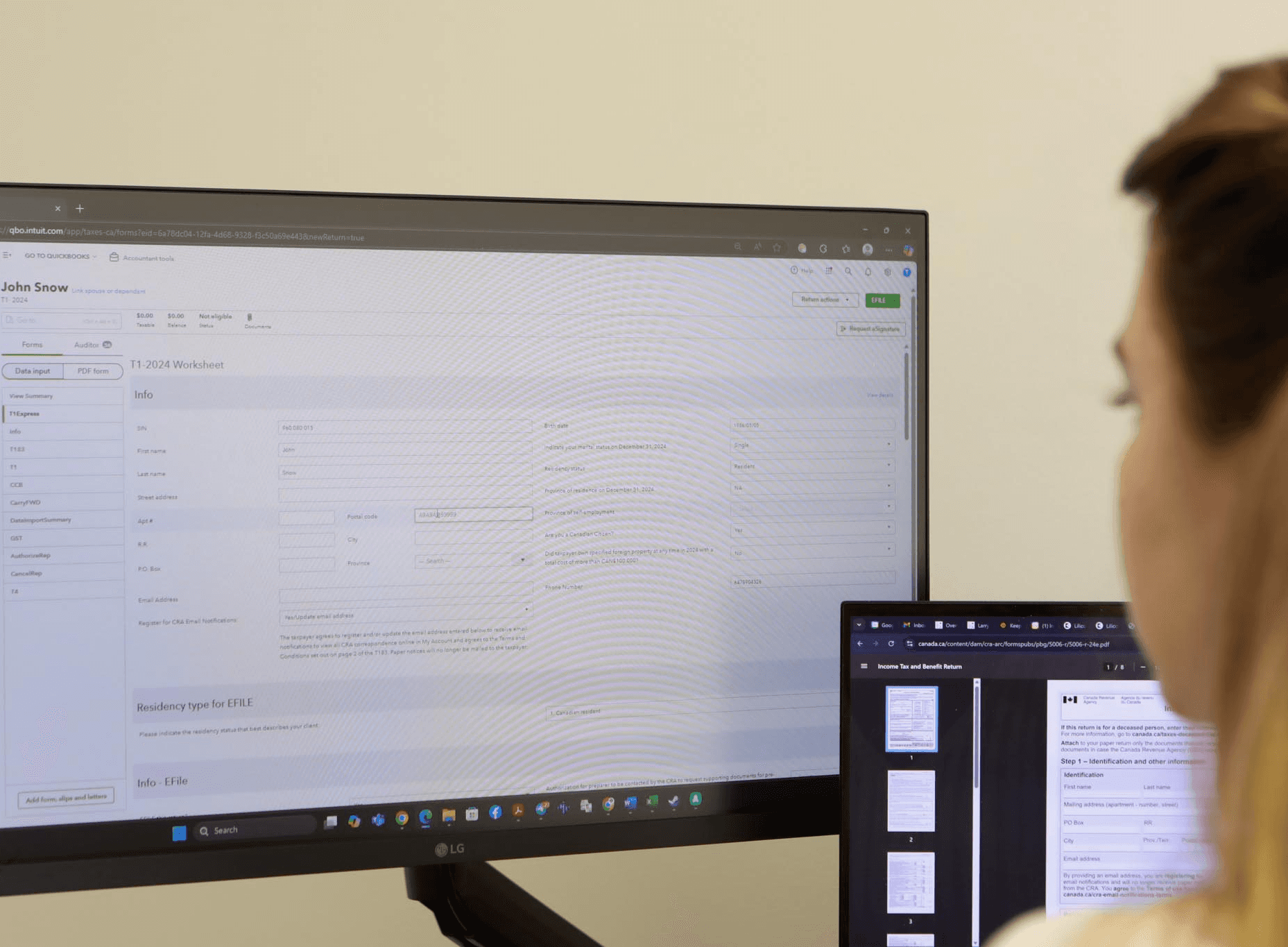

You'll work with the same tools used by professionals — including CRA portals, Wealthsimple Tax, and Pro Tax Online. Along the way, you'll learn to navigate real tax slips, fill out actual forms, and apply Canadian tax law in practical scenarios. Everything is designed to help you feel confident, capable, and ready.

You'll work with the same tools used by professionals — including CRA portals, Wealthsimple Tax, and Pro Tax Online. Along the way, you'll learn to navigate real tax slips, fill out actual forms, and apply Canadian tax law in practical scenarios. Everything is designed to help you feel confident, capable, and ready.

Opportunities

Opportunities

Opportunities

After this course, you’ll be able to file your own taxes, support family and friends, or take the first step toward launching a tax prep business. Some students even start earning during the same tax season. With tax knowledge in high demand across Canada, what starts as a course can open real doors.

After this course, you’ll be able to file your own taxes, support family and friends, or take the first step toward launching a tax prep business. Some students even start earning during the same tax season. With tax knowledge in high demand across Canada, what starts as a course can open real doors.

Pricing & Curriculum

Compare course options

Compare course options

We designed three course options to suit different goals and experience levels. Whether you are filing for yourself or building a business, there is a path here for you.

Introduction & Tax History

Payroll, CPP & EI Basics

T1 General Structure

Employment Income

Donation and Medical

Childcare expenses

Refundable Credits

Pensions & Retirement

Deduction Optimization

Other Deductions

Employment Expenses

Moving & Northern Deductions

Foreign Income & Property

Residence in Depth

Asset Sales

Investment Income

Accounting and Bookkeeping

Sales Tax

Self-Employment

Rental Income

Registrations

Advanced Filing Software

Client Management

Client Engagement

Engagement with CRA

Introduction & Tax History

Payroll, CPP & EI Basics

T1 General Structure

Employment Income

Donation and Medical

Childcare expenses

Refundable Credits

Pensions & Retirement

Deduction Optimization

Other Deductions

Employment Expenses

Moving & Northern Deductions

Foreign Income & Property

Residence in Depth

Asset Sales

Investment Income

Accounting and Bookkeeping

Sales Tax

Self-Employment

Rental Income

Registrations

Advanced Filing Software

Client Management

Client Engagement

Engagement with CRA

Standard

Complex

Pro

Introduction & Tax History

Payroll, CPP & EI Basics

T1 General Structure

Employment Income

Donation and Medical

Childcare expenses

Refundable Credits

Pensions & Retirement

Deduction Optimization

Other Deductions

Employment Expenses

Moving & Northern Deductions

Foreign Income & Property

Residence in Depth

Asset Sales

Investment Income

Accounting and Bookkeeping

Sales Tax

Self-Employment

Rental Income

Registrations

Advanced Filing Software

Client Management

Client Engagement

Engagement with CRA

Introduction & Tax History

Payroll, CPP & EI Basics

T1 General Structure

Employment Income

Donation and Medical

Childcare expenses

Refundable Credits

Pensions & Retirement

Deduction Optimization

Other Deductions

Employment Expenses

Moving & Northern Deductions

Foreign Income & Property

Residence in Depth

Asset Sales

Investment Income

Accounting and Bookkeeping

Sales Tax

Self-Employment

Rental Income

Registrations

Advanced Filing Software

Client Management

Client Engagement

Engagement with CRA

Standard

$350

Learn to file your own personal tax return. Perfect for anyone.

Introduction & Tax History

Payroll, CPP & EI Basics

T1 General Structure

Employment Income

Donation and Medical

Childcare expenses

Refundable Credits

Pensions & Retirement

Deduction Optimization

Other Deductions

Employment Expenses

Moving & Northern Deductions

Foreign Income & Property

Residence in Depth

Asset Sales

Investment Income

Accounting and Bookkeeping

Sales Tax

Self-Employment

Rental Income

Registrations

Advanced Filing Software

Client Management

Client Engagement

Engagement with CRA

Introduction & Tax History

Payroll, CPP & EI Basics

T1 General Structure

Employment Income

Donation and Medical

Childcare expenses

Refundable Credits

Pensions & Retirement

Deduction Optimization

Other Deductions

Employment Expenses

Moving & Northern Deductions

Foreign Income & Property

Residence in Depth

Asset Sales

Investment Income

Accounting and Bookkeeping

Sales Tax

Self-Employment

Rental Income

Registrations

Advanced Filing Software

Client Management

Client Engagement

Engagement with CRA

Complex

$850

Learn to file your own personal tax return. Perfect for anyone.

Introduction & Tax History

Payroll, CPP & EI Basics

T1 General Structure

Employment Income

Donation and Medical

Childcare expenses

Refundable Credits

Pensions & Retirement

Deduction Optimization

Other Deductions

Employment Expenses

Moving & Northern Deductions

Foreign Income & Property

Residence in Depth

Asset Sales

Investment Income

Accounting and Bookkeeping

Sales Tax

Self-Employment

Rental Income

Registrations

Advanced Filing Software

Client Management

Client Engagement

Engagement with CRA

Introduction & Tax History

Payroll, CPP & EI Basics

T1 General Structure

Employment Income

Donation and Medical

Childcare expenses

Refundable Credits

Pensions & Retirement

Deduction Optimization

Other Deductions

Employment Expenses

Moving & Northern Deductions

Foreign Income & Property

Residence in Depth

Asset Sales

Investment Income

Accounting and Bookkeeping

Sales Tax

Self-Employment

Rental Income

Registrations

Advanced Filing Software

Client Management

Client Engagement

Engagement with CRA

Pro

$999

Learn to file your own personal tax return. Perfect for anyone.

Convenient payment

From $87.50 x 4

From $87.50 x 4

The full course price depends on the package chosen. To make things easier, you can split the payment into four equal parts with no commissions or interest using Klarna or Afterpay. After clicking Enroll, you’ll be redirected to our learning platform to complete your registration.

The full course price depends on the package chosen. To make things easier, you can split the payment into four equal parts with no commissions or interest using Klarna or Afterpay. After clicking Enroll, you’ll be redirected to our learning platform to complete your registration.

Lessons Schedule

Lessons Schedule

Ukrainian Language Classes:

Date of the first lesson: January 19 (Monday) at 6:00 PM EST. Then every Monday at 6:00 PM and Saturday at 2:00 PM EST.

Course author

Mariia Irodiuk

Mariia Irodiuk

Founder of Lilico, Chief Accountant and the course author. Maria is an expert not only in accounting, but also in building businesses, teams and systems. She conducts additional lessons and is always in touch to help students.

Take a look behind the scenes

How does the training happen

How does the training happen

Learning platform

All theoretical lessons are available on the Kwiga platform in recordings. This is where you can track your own learning progress.

Online meetings

Practical classes will be held online, under the guidance of a teacher, at the time specified in the course schedule.

Support

Our teachers are available 7 days a week, and as part of the course we have created a Whatsapp chat for students. Some classes also include group assignments and team projects. We will not leave anyone without support!

Certification

To receive a certificate, you must pass an exam after completing your studies.

Wall of love

What our students say about us

What our students say about us

FAQ

FAQ

Will we learn how to file tax returns in every province?

How long does the study program take?

How long will recorded lessons be available?

How do I find out about successful payment and access to the course?

How to register for the course?

What should I do if I miss a class?

Will we learn how to file tax returns in every province?

How long does the study program take?

How long will recorded lessons be available?

How do I find out about successful payment and access to the course?

How to register for the course?

What should I do if I miss a class?

Will we learn how to file tax returns in every province?

How long does the study program take?

How long will recorded lessons be available?

How do I find out about successful payment and access to the course?

How to register for the course?

What should I do if I miss a class?

Still have questions?